Why Long-Term Industrial Real Estate Investing Works, Especially in Chicagoland

Industrial real estate rarely dominates headlines, yet it has quietly proven to be one of the most durable long-term investment categories in commercial real estate. While other sectors move in and out of favor, long-term industrial real estate investing has continued to deliver stable income and consistent value growth across market cycles.

Within that broader category, not all markets perform the same. Over decades of ownership, small industrial buildings in the Chicagoland area, particularly those under 30,000 square feet, have shown unique staying power. Their performance is not accidental. It is tied to geography, infrastructure, supply constraints, and how real businesses operate.

Industrial Real Estate Is Built on Economic Necessity

Industrial real estate exists to support production, storage, and distribution. Demand is driven by function rather than trends. Businesses need space to receive goods, stage inventory, assemble products, and move materials efficiently.

This creates meaningful long-term advantages. Tenants often invest heavily in their locations, making relocation costly and disruptive. As a result, leases tend to be longer, renewals more common, and turnover less frequent. Over extended holding periods, these industrial real estate investment benefits translate into steadier occupancy and more predictable cash flow.

These fundamentals become even stronger in markets that matter to logistics, and few markets matter more than Chicago.

Chicagoland’s Role as a National Logistics Hub

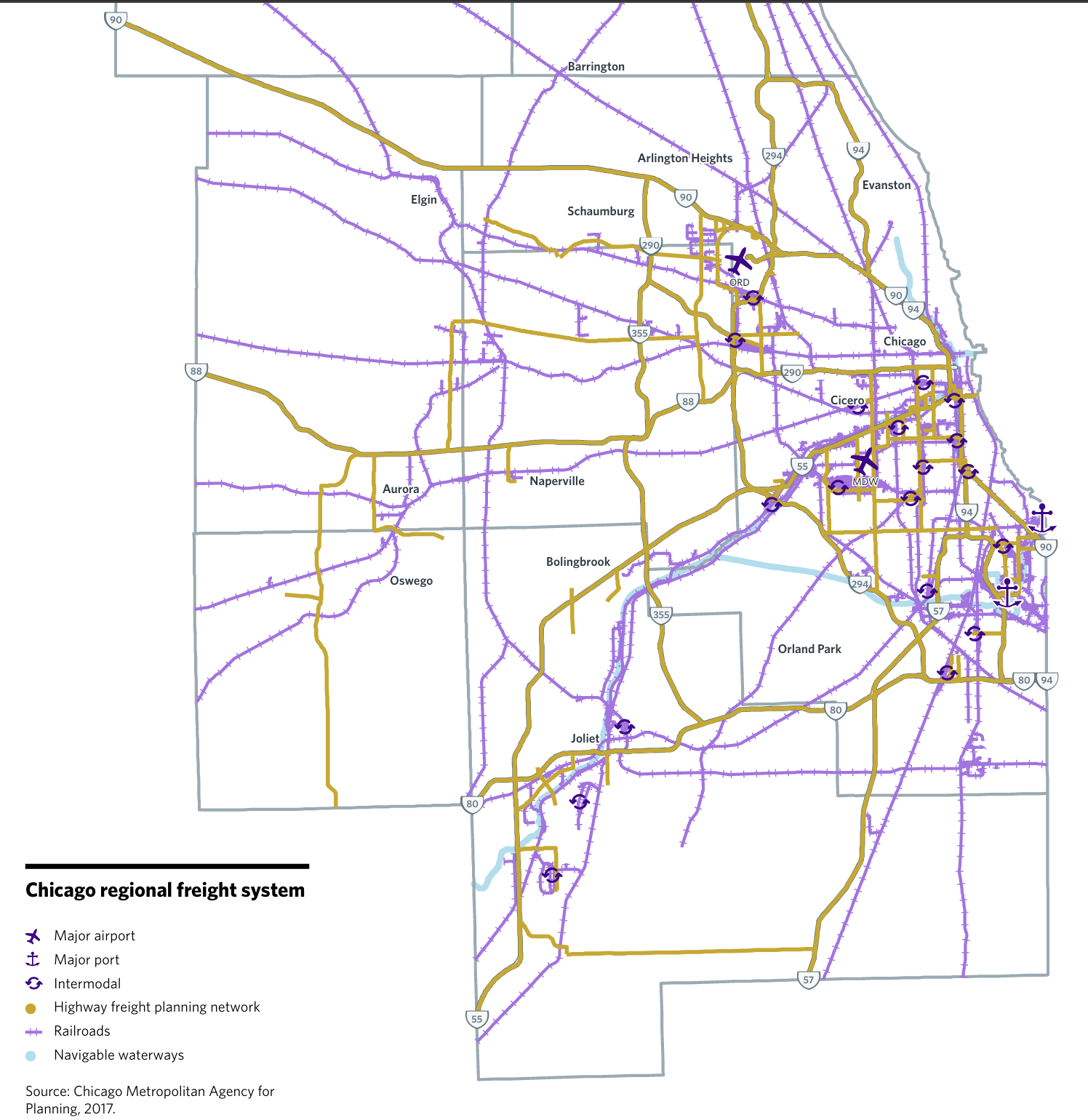

Chicago sits at the intersection of the nation’s freight and logistics networks. The region offers direct access to multiple interstate highways, one of the largest freight rail systems in North America, and O’Hare International Airport, a major air cargo hub.

This multimodal infrastructure allows companies to reach a large share of the U.S. population within one or two days by truck. For distributors, manufacturers, and service providers, that efficiency is difficult to replace. Importantly, this advantage is not limited to large distribution centers. Smaller industrial buildings play a critical role in last-mile delivery, regional staging, and light manufacturing that requires proximity rather than scale.

Bird's-eye view of Elk Grove Village, Illinois, the largest consolidated industrial park in North America, featuring over 62-65 million square feet of inventory and 5,600+ businesses, serving as a premier logistics and manufacturing hub adjacent to O'Hare International Airport.

Why Small Industrial Buildings Under 30,000 Square Feet Matter

A meaningful portion of Chicagoland’s industrial inventory consists of small buildings located near established transportation corridors and population centers. These properties serve a broad tenant base that includes local distributors, trades, light manufacturers, and service businesses.

For these users, flexibility and location matter more than size. A functional 15,000 or 25,000 square foot building close to customers and highways can be more valuable than a larger facility farther from core markets.

From an investment standpoint, this creates durable demand. Smaller tenants are less likely to chase new construction and more likely to prioritize operational continuity, which supports long-term occupancy.

Limited New Supply Supports Long-Term Stability

New industrial development overwhelmingly targets large logistics facilities. Building small industrial properties in infill locations is far more difficult due to zoning restrictions, land scarcity, and rising replacement costs.

As a result, the supply of sub-30,000 square foot buildings is structurally constrained. Many of these properties would be expensive or impossible to replace today. This supply discipline helps explain why vacancy in the small industrial segment tends to remain stable even when broader markets soften.

For long-term owners, limited new supply reinforces both occupancy and rent durability.

Industrial real estate long term returns are rarely driven by dramatic appreciation. Instead, they are built through steady income, modest rent growth, and incremental equity accumulation over time.

Industry data shows that industrial properties have delivered competitive long-term returns with lower volatility than many other commercial asset classes. In Chicagoland’s small industrial market, those returns are reinforced by diversified tenant demand, central logistics relevance, and limited exposure to speculative overbuilding.

This allows investors to benefit from time in the market rather than relying on timing the market.

Why This Market Continues to Reward Patient Investors

Small industrial buildings in Chicagoland may not attract attention, but they serve businesses that keep goods moving and economies functioning. Their relevance is tied to infrastructure, not sentiment.

For investors focused on durability, stable income, and long-term capital preservation, this segment offers a compelling combination. Rather than depending on momentum or short-term exits, value is created through consistent demand, disciplined ownership, and the simple act of holding quality assets over time.

That is why long-term industrial real estate investing, particularly in Chicagoland’s small-building market, continues to work quietly and reliably.

Start a Conversation With Our Team

If you are interested in learning more about investing in our industrial real estate syndication opportunities, we invite you to complete our investor inquiry form.

Once submitted, Joel, Eric, or a member of our team will reach out to discuss our current and upcoming investments, walk through our investment approach, and answer any questions you may have about the process.

Fill out the investor inquiry form to get started:

https://www.britproperties.com/contact-us